Biotech lobby’s push for new GMOs to escape regulation

'New Breeding Techniques' the next step in corporate control over our food?

The biotech industry is staging an audacious bid to have a whole new generation of genetic engineering techniques excluded from European regulations. The pending decision of the European Commission on the regulation of these so-called 'new GMOs' represents a climax point in the ongoing below-the-radar attack by industry on GM laws.

PDF version of this article

Versión de este artículo en PDF (en castellano)

1. Introduction

The EU's GM regulations have long been a thorn in the biotech industry's side. For their lobbyists, the Commission decision presents a unique opportunity to twist the interpretation of these rules – including the very definition of a GMO – so as to exclude the new genetic engineering techniques from their scope. This goes alongside ongoing industry attacks on the application of the precautionary principle – the basis of EU GM regulations – to novel food production techniques.

New genetic engineering techniques, which have emerged since Europe’s GMO law was introduced in 2001, are currently being applied by developers to food crops, trees, farm animals and insects. If the industry lobby campaign is successful, new GM organisms and foods – produced by techniques including oligonucleotide-directed mutagenesis (ODM), agroinfiltration and zinc finger nuclease technology (ZFN) - could enter the environment and the food chain untested, untraceable and unlabeled. Dozens of patents have already been filed in this field by the big agrochemical corporations like Bayer, BASF, Dow Agrosciences and Monsanto.

Due to widespread consumer rejection of GMOs, invisibility is vital for the commercial success of any new genetically engineered product in Europe. Their unregulated mass release could however have far-reaching consequences for the environment, food safety and consumer choice. Therefore, calls from farmers and environmental groups to regulate the new GM are increasing. The techniques in question each bring their own set of risks and uncertainties. Technical reports and legal analyses by government bodies and NGOs have concluded that GM 2.0 should not escape the EU GM regulations.1 Whilst some risks are similar to those associated with GM 1.0, there are also serious additional concerns.2

To further its cause, industry has set up a dedicated, EU-level lobbying vehicle – the New Breeding Techniques Platform – with the mission of having as many of the new GM t echniques as possible excluded from EU GM regulations. This platform is run by Schuttelaar & Partners, a Dutch lobby and PR firm with a shady reputation for pro-GM lobbying. At the same time, individual companies have been pressing various European governments to clarify the legal status of the new genetic engineering techniques, while announcing plans to field trial them in those countries. Furthermore, certain governments have been actively advocating the deregulation of new GM techniques at the EU level.

The ongoing negotiations around the Transatlantic Trade and Investment Partnership (TTIP) are an additional source of political pressure on European decision makers. In this context, industry lobby groups have presented the regulation of new GM techniques as a trade concern to both US and EU officials,3 claiming that the innovative nature and competitiveness of the European plant breeding (read: biotech) sector is at stake.

After contemplating this question for eight years, the Commission finally plans to publish a draft decision in February 2016. This briefing, based on documents released by the European Commission following freedom of information requests, illuminates the efforts made over the past three years by the industry lobby to have the new GM techniques deregulated. In addition, a first case study highlights the Dutch lobby campaign for the deregulation of cisgenesis, and a second one looks at US company Cibus's push for the deregulation of its ODM oilseed rape.

2. A lengthy process

The European Commission turned its attention to the new GM techniques eight years ago, setting up a 'New Techniques Working Group' (NTWG) in October 2007 to assess whether the GM techniques listed above give rise to products falling within the scope of the GMO legislation. However, its final report showed that the working group was divided on the regulatory status of some of the techniques, therefore leaving the Commission with no clear plan of action.4

What are the new GM techniques?The list of new GM techniques currently being considered by the Commission includes Oligonucleotide-Directed Mutagenesis (ODM); Zinc Finger Nuclease technology (ZFN) comprising ZFN-1, ZFN-2 and ZFN-3; Cisgenesis and Intragenesis; Grafting; Agroinfiltration; RNA-dependent DNA methylation (RdDM); and Reverse Breeding.5 Most of these techniques are also called 'gene editing editing' techniques: instead of introducing genetic traits from another organism the genome can be directly 'rewritten' in the cells.6 Indeed, companies appear to be deliberately investing in techniques designed to circumvent the EU's GMO regulations. As an expert for the US Consumer Union has noted, “All these new technologies are ways to weasel around a very narrow definition of transgenic. I would consider that misleading to the public.”7 An industry lobby document sent to EU decision makers in 2013 could not be clearer about the industry's motivation to develop new GM techniques: they were developed “as a response to the de facto moratorium on GMOs that currently exists in Europe.”8 These investments, and the many related patent applications, now demand a financial return. |

In parallel to the analysis carried out by this Working Group, the Commission requested opinions from the European Food Safety Agency (EFSA) about the risks posed by cisgenesis, intragenesis and Zinc Finger Nuclease 3, and whether existing risk assessment methods were adequate for evaluating them.9 10

EFSA opinions on three techniquesWith respect to cisgenesis and intragenesis, EFSA concluded that while intragenic plants would generate similar risks to transgenic ones, cisgenic plants could be compared to conventionally bred plants. However, the agency clarified that “all of these breeding methods can produce variable frequencies and severities of unintended effects. The frequency of unintended changes may differ between breeding techniques and their occurrence cannot be predicted and needs to be assessed case by case.”11 Furthermore, EFSA opined that ZFN-3 requires in principle the same risk assessment that is currently applied to GMOs, but that on a case-by-case basis “lesser amounts of data may be needed” for plants developed using this technique. |

In 2012, the Commission reported that it was working with member states to find the best way forward in clarifying the regulatory status of the new techniques.12 In a presentation to the European Seed Association, the Commission claimed to be looking not only at the legal aspects, but also at “safety considerations, the approach in third countries, the chances and risks involved, and the view of European plant breeders”.13

Just months later, at a meeting with the industry-led NBT Platform, the Commission had changed course. It was later clarified that due to “the absence of consensus amongst the main political EU actors, reflecting the public hostility to GMOs”, the Commission had opted for a legal guidance document interpreting Directive 2001/18, rather than for new legislation. This means that the European Parliament plays no formal role, and that member states are expected to follow the Commission's recommendations. In the case of disagreement, the European Court of Justice has the final say.14

The Commission has time and time again postponed the deadline for delivering the legal guidance document. In response to the many queries from industry and member states on its progress, the standard response has been that assessing the new techniques in the light of Directive 2001/18 “... is complex and requires a thorough technical and legal analysis”.15

As the Commission indicated, the member states were divided. Certain EU governments, including the UK, the Netherlands and Germany, pressured the Commission to deregulate one or more of the techniques. The Netherlands for instance has invested considerable public research funding in promoting the cisgenic GMOs developed by Wageningen University, and the Commission has been pressured by Dutch Ministries, the Permanent Representation in Brussels, the national parliament, and Dutch MEPs. (See case study Of apples and potatoes: the Dutch lobby for the deregulation of cisgenesis).

Not surprisingly, corporations have been itching to get started on field trials of the new GM crops. Between 2012 and 2014, BASF16 and the US company Cibus (among others) approached several member states, including the UK, Sweden and Finland, to ascertain the regulatory status of one of the techniques – Oligonucleotide-Directed Mutagenesis (ODM) – and to obtain clearance to field trial ODM herbicide-tolerant oilseed rape without having to undergo the regulatory risk assessment required of GMOs. (See case study 'US company railroads EU decision making on new GM').

This resulted in the Finnish government complaining to the Commission about the lack of clarity of direction on ODM, leaving the national competent authorities “in a legally challenging position” since they were obliged to respond to the companies.17 Helsinki gave the Commission an April 2014 deadline to respond, but again the Commission told them to be patient.18

3. 'New Breeding Techniques Platform': corporations unite to deregulate GMOs

The trail of Freedom of Information requests over the past three years to the European Commission illuminates industry's efforts to have new genetic engineering techniques escape regulation. These efforts are coordinated by the New Breeding Techniques (NBT) Platform, whose objective is to have “all NBTs – or as many techniques as possible – exempt from GM legislation”.19 The Brussels office of Dutch lobby and public relations firm Schuttelaar & Partners (their motto: “science-based consultancy with sense”) was hired to chair the NBT Platform and coordinate its lobby activities.

This was perhaps not a surprising choice, as company materials show that Schuttelaar & Partners’ recent clientèle includes various biotech industry actors whose interests are served by the NBT Platform (for example Syngenta, Bayer CropScience, Dow AgroSciences, biotech lobby association EuropaBio and Inova Fruit). Also, the firm has not shunned highly damaging industry campaigns in the past: its first triumph was tricking decision makers into allowing Monsanto's herbicide-tolerant soy to flood the European market (See Box 'Schuttelaar & Partners: no novice to below-the-radar lobby campaigns for biotech clients').

Schuttelaar & Partners: no novice to below-the-radar lobby campaigns for biotech clientsIn 1995, the firm was hired by Monsanto to secure a smooth introduction for the first imports of a GM crop – Monsanto's herbicide-tolerant Roundup Ready soy – to Europe.20 Schuttelaar & Partners was set up by Marcel Schuttelaar, a former campaigner for Friends of the Earth Netherlands. Familiar with Monsanto's adversaries as an insider and an outsider, he was the ideal man for the job. The strategy chosen was to ‘let sleeping dogs lie': carefully injecting tranquillising messages into the right ears in order to avoid a sudden outcry from media and consumer organisations. The lobby firm – not hindered by a lack of evidence - stressed the 'benefits' of Roundup Ready soy, such as reduced pesticide use (a claim that has proven to be untrue). By subtly expanding the European market, Schuttelaar & Partners helped pave the way for the further expansion of GM soy monocultures in South America. Ironically, 15 years later, the firm was hired by and participated in the Round Table on Responsible Soy (RTRS), which includes Monsanto in its membership.21 The RTRS is a voluntary labelling scheme that certifies GM Roundup Ready soy as 'responsible', although its empty criteria do nothing to protect local communities or reduce deforestation and pesticide use.22 |

Any self-respecting PR firm designing a lobbying campaign will start off by rebranding its client's product and developing a new lexicon to pitch it to decision makers.

The NBT Platform, with its very name, has rebranded the new GM techniques as 'new breeding techniques' to make them sound different from 'genetic engineering'. Not without success: the European Commission and other regulatory bodies have fully adopted this term in their communication on the topic. Angelika Hilbeck, senior researcher at the Swiss Federal Institute of Technology, says: “'New breeding techniques' is a misleading term, precisely because the users of these techniques aim to avoid any breeding. They simply allow the maintenance of a successful market variety, and the improvement of an agronomic problem that primarily arises from monoculture production methods that promote disease and the prevalence of pests. The products will be sold under the same familiar names, except they are now patented and – if industry gets its way - not labelled as GM. The techniques are non-innovative, and just like GM 1.0, are primarily a business model.”

Other labels in the new lexicon, such as 'gene editing' or 'genome editing', are used to emphasise surgical precision and to suggest absolute technological control of the genetic engineering process. However, as Hilbeck points out, precision in changing an organism's genetic makeup is not equivalent to safety if you do not fully understand what you are changing and the knock-on impacts. “It's like changing letters in words and words in text in a language one does not understand. That can be done with precision and control, yet with complete oblivion to the meaning”, she says.

Another key ingredient is to develop a narrative that tells how indispensable the product will be for the greater good – even if you can't come up with anything new. (See box 'New GM, same old pitch?').

New GM, same old pitch?So why do we need a new generation of GM? The NBT Platform and other deregulation advocates echoe the arguments in favour of introducing GM crops 20 years ago in their pitch for the new GM techniques.23 24 25 26 They invariably cite some of the key challenges faced by society today, notably “rapid world population growth, climate change, and increasing scarcity of resources such as soil and water”.27 New GM techniques, it is said, will come to the rescue by massively improving the precision and speed of the plant breeding process. Important objectives allegedly include pest resistance and drought tolerance. Yet the very first new GM crop in the pipeline, developed by the US company Cibus, is another herbicide-tolerant oilseed rape. Herbicide-tolerant GM crops have waged social and environmental havoc in the countries where they are mass produced.28 Many GM 2.0 patent applications are related to traits such as herbicide-tolerance, insecticide production and changed oil composition - the same as GM 1.0.29 Furthermore, the claims about the benefits of GM 1.0 have been refuted time and again.30 |

Schuttelaar & Partners describes the work of the NBT Platform as providing decision makers with “independent science-based information” on the techniques, and generating awareness about “their widespread benefits” for the European economy.31 32 But the NBT Platform is far from independent, with the private sector making up the bulk of its membership and providing most of the funding. The membership fee structure, as provided on the Platform's website, lists annual subscription fees of €7,000 for Small and Medium-sized Enterprises (SMEs), €22,500 for large companies, and €2,500 for scientific institutions.33

However, none of this is evident from the EU Transparency Register entries of the NBT Platform and Schuttelaar & Partners. In fact, the entries of both parties exemplify the often meaningless, incomplete and incorrect information provided by corporations and lobby firms to this register. In this case, the NBT Platform's first listing in the Transparency Register is from April 2015, at least three years after its foundation. The connection to Schuttelaar & Partners is not mentioned, and neither the Platform members nor the funding sources are disclosed.34 (Also see box 'Transparency register generates confusing and incorrect data on NBT Platform').

Transparency register generates confusing and incorrect data on NBT PlatformIn the EU Transparency Register, the NBT Platform claims that its lobby expenses total a mere €50,000-99,999 per year. This figure is not very meaningful, since every entity can invent its own way to calculate lobby expenses when signing up to the register. As the Platform's overall budget is not disclosed, lobby costs might in fact be much larger. Furthermore, the NBT Platform entry reports only a 0.5 FTE workload dedicated to the wide range of lobby activities falling under the scope of the register.35 Schuttelaar & Partners Director Edwin Hecker is named as chair of the Platform, and the number of lobbyists with permanent accreditation to the European Parliament is registered as zero. However, in Schuttelaar & Partners' own entry to the EU Transparency Register, Hecker is mentioned as one of ten company employees holding a permanent accreditation pass to the European Parliament. |

There is more information available on the NBT Platform’s own website, but this was only launched in July 2015. The site lists the following members: Syngenta, KeyGene, Inova Fruit, SESVanderHave, Rijk Zwaan, Meiogenix, SweTree Technologies, Semillas Fitó, Enza Zaden, Rothamsted Research, VIB (Flemish Biotechnology Institute), Fondazione Edmund Mach and the John Innes Centre.36 Commission documents however indicate that Dow Agrosciences and Bayer CropScience's vegetable seed business Nunhems were also at some point members of the Platform and, in any case, attended NBT meetings.37 38

The NBT Platform does not let an opportunity pass to stress the interests of SMEs and research institutes in its lobby to get new GM deregulated. However, taking the EU definition of a SME as a company with fewer than 250 employees, only three Platform members qualify: KeyGene, Meiogenix and SweTree Technologies.39 Furthermore, some of the ‘public’ research institutes that the NBT Platform represents have strong financial ties with industry. For instance, Rothamsted Research (UK) has many joint projects with agribusiness corporations.40 And no less than one third of the general council membership of the Flemish Biotechnology Institute (VIB) is made up of industry representatives, including Syngenta and Bayer.41

Indeed, it is important to note that these biotech SMEs and research institutes often play the role of technology suppliers for big multinationals. SweTree Technologies, for example, is engaged in the development of GM trees and claims to have applied for 75 patents in that field. Some of these products have already been licensed to BASF, and SweTree Technologies claims to collaborate with the corporation in several areas.42

4. Multi-phased lobby campaign against EU GMO regulation

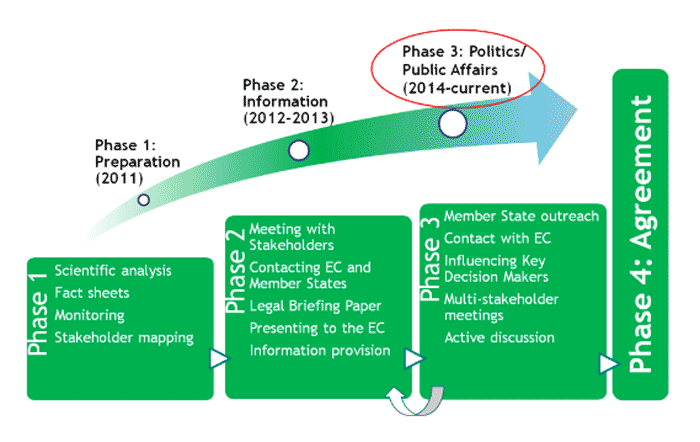

The NBT Platform’s website clearly delineates the four phases of its campaign to give the death blow to GMO regulation for new GM products.43

Source: NBT Platform website.

Following the creation of the NBT Platform in the first phase, the second phase in the industry’s lobby campaign to the European Commission was characterised by repeated efforts to showcase the new techniques and their claimed benefits, as well as the provision of technical and legal arguments for why they should go unregulated.

In the spring of 2012 for example, Schuttelaar & Partners teamed up to chair two meetings presenting new GM techniques to staff from DG SANCO, DG Trade, and DG Research and Innovation.44 45 Dow presented Zinc Finger Nuclease (ZFN) technology; Rijk Zwaan introduced agroinfiltration and reverse breeding; Bayer/Nunhems explained cisgenics; KeyGene made a pitch for ODM; and VIB put forward grafting on GM root stock. Syngenta and Inova Fruit were also present at the meetings.

In addition, a legal argumentation as to why the EU should not regulate ODM and cisgenics techniques in particular was presented by Wageningen University plant researcher Henk Schouten, who was also wearing his hat as lobbyist for Inova Fruit.46 Inova Fruit, owned by large Dutch and Flemish fruit traders, contracted the private arm of Wageningen University to develop cisgenic apple varieties.47 48 Both Wageningen University and Inova Fruit clearly have commercial interests in getting cisgenesis deregulated. This shows the involvement of Wageningen University in private interest lobbying, despite its public denial of this kind of activity. (See case study Of apples and potatoes: the Dutch lobby for the deregulation of cisgenesis).

Trade concerns (1): avoiding disruptions at all costsIn lobbying the Commission, DG Trade was not left out. In a first meeting in March 2012, Schuttelaar & Partners raised their clients’ concerns about “the legislative uncertainty” for new GM techniques, and added that in this field “the EU occupies the second place in the world for patent applications, with the UK and the Netherlands contributing most significantly”.49 In late May 2012, Schuttelaar & Partners staged a second larger meeting, attended by DG SANCO, DG Trade, and “NBT Platform members” Dow Agrosciences, VIB, KeyGene, Syngenta, Bayer CropScience, Rothamsted Research, Rijk Zwaan, and Wageningen University.50 Their message did not fall upon deaf ears. After the first meeting, a DG Trade official concluded that his DG would “have to ensure that any measure/solution proposed will not result in trade disruptions”. And furthermore, he reported: “I was reassured by my SANCO counterparts that the trade angle will be taken into account when deciding on the Commission’s line to take”.51 |

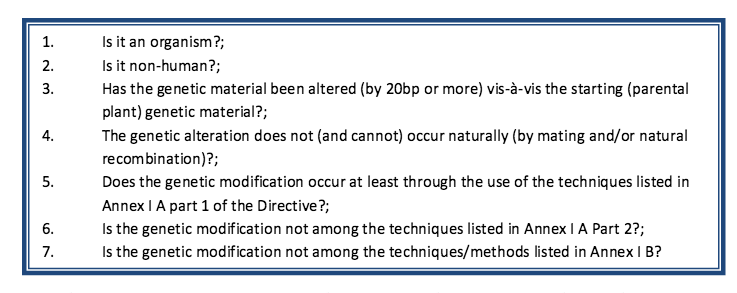

In May 2013, the NBT Platform presented the Commission with its pièce de résistance: the industry’s own ‘legal interpretation’ of the regulatory status of new GM techniques.53 This was based on a sort of questionnaire consisting of seven main questions (and many subquestions) that, it is explained, must all be answered in the affirmative in order for a product to be regulated as a GMO. This methodology was carefully designed to ensure the desired outcome: that all of the new GM techniques in question should be unregulated, and by extension untested and unlabelled.54

Source: NBT Platform website.

Question 3 and 4 aim to twist the definition of a GMO in EU Directive 2001/18, which is “...an organism, with the exception of human beings, in which the genetic material has been altered in a way that does not occur naturally by mating and/or natural recombination”. Using industry's methodology, most of the new techniques would escape regulation as they can provide a negative answer to one of these two questions. The Platform analysis also argues that some of the new GM techniques are simply a variation of mutagenesis (a technique that had long been in use when Directive 2001/18 was developed and that was explicitly excluded from its scope).55 Furthermore, the industry approach aims to undermine the process-based nature of the Directive, as described earlier.

The arguments put forward by the NBT Platform are at the core of industry's rationale for the deregulation of new GM. These points, or variations on them, can also be found in lobby documents produced by the European Seed Association (ESA), the European Plant Science Organisation (EPSO), the pesticide lobby group Croplife International and the Flemish biotech research institute VIB.

The pro-deregulation interpretation of the scope of Europe’s GM laws has been met with wide-ranging criticism. Counter-arguments have been provided by German federal agencies (for example the opinion by Professor Tade Matthias Spranger for BfN, the German Federal Agency of Nature Conservation); a legal analysis by Professor Ludwig Krämer as commissioned by German civil society; and assessments by Greenpeace, farming and other environmental groups. Similarly, industry’s attempt to have new GM declared safe by design and therefore exempt from regulatory risk assessment has been countered by the Austrian Environmental Agency and various non-governmental organisations.

The legal case that new GM techniques should be covered by the current regulations is, in fact, crystal clear.

The central purpose of Directive 2001/18 on the deliberate release of GMOs is to protect human health and the environment from the release of genetically modified organisms. The Directive clearly provides for the advent of new GM techniques, which rely upon in vitro methods to directly modify genomes. These are the very type of techniques that EU law covers with its process-based approach (where the technique used decides if the regulations apply). That process-based regulation and the precautionary approach that lies at the heart of the directive are justified because of the unintended and unexpected effects of both GM 1.0 and GM 2.0 techniques. Techniques that have been developed since 2001 (or that didn't have any commercial application prior to 2001) cannot be regarded, as industry argues, the same as traditional mutagenesis techniques that were exempted on the grounds of a claimed 'history of safe use' when the EU regulations were introduced.

The key arguments from industry, and counter-arguments are summarised in the following table:

Table: Key industry arguments for the deregulation of new GM techniques

Industry argument56 | Response57 |

1. “New GM is just like traditional plant breeding.” | In EU law, a GMO does not need to contain foreign DNA to qualify as a GMO. |

2. “Just because a GM technique is used does not mean that the product is legally a GMO.” | The EU has recognised that the GM technique used to change an organisms does matter. |

3. “Gene editing techniques are a form of mutagenesis.” | New gene editing techniques are different and have no 'history of safe use'. |

4. “New GM is 'safe by design'.” | New GM techniques can have multiple unintended and unexpected results. |

5. “Detection is impossible.” | Detection methods are evolving, as are genetic engineering techniques. |

6. “Application of the precautionary principle should be reconsidered.” | Precautionary principle should be respected. |

5. Last phase lobbying

The third phase of the industry campaign, indicated in the graph by ‘Politics/Public Affairs’ (read: 'Lobby'), kicked in with a so-called 'multi-stakeholder meeting' held on 25 June 2014. ‘The future of plant breeding techniques in the European Union’58 was a co-production of the NBT Platform and the industry-driven European Technology Platform 'Plants for the Future'. However, the NBT Platform cast a narrow net when inviting ‘stakeholders’: on its list were the Member States' Competent Authorities, the Commission, and companies and their lobby associations (e.g. the European Seed Association, farming lobby Copa-Cogeca, and so forth). Absent were environmental and consumer NGOs, sustainable farming organisations, and the like.59

The industry campaign escalated during this phase, with dire predictions of economic collapse and job losses following the eventual regulation of new GM. According to the NBT Platform multi-stakeholder meeting report for example, industrial farming group Copa-Cogeca said that “overly strict” regulation would “increase unfair competition” for farmers. In turn, the European Plant Science Organisation (EPSO) insisted that the current legal uncertainty was causing “intelligence leakage” and destroying jobs, while another participant went as far as to warn that this ambiguity would lead to the “complete extinction” of a large part of the plant breeding sector in Europe!60

Trade concerns (2): TTIP kicks inAnother line of argument pursued by the NBT Platform is the comparison of how new GM techniques are regulated – or not – in other parts of the world, cumulating in the suggestion that a stronger level of regulation in the EU will create trade barriers. In the context of TTIP, the way the US deals with the new techniques is of particular interest. For example, US-based multinational Dow informed DG SANCO in 2013 of the decision by the US Department of Agriculture (USDA) to not regulate Dow's ZFN-1 maize.61 The Commission later reflected however that the US Food and Drug Administration (FDA) “remains rather vague” on the issue.62 It should be noted that the US hardly regulates GMOs as such. There are no formal data requirements when it comes to safety testing, and biotech companies voluntarily provide whatever information they please. Emails released by the Commission provide evidence that the (de-)regulation of new GM techniques was indeed discussed in a March 2014 TTIP-related meeting in Washington. Despite repeated claims at the time by the Commission that “GM is not on the table”, US and EU authorities sat together with seed industry lobby groups from both sides of the Atlantic (including the European Seed Association).63 |

By the start of 2015, the Commission appeared close to reaching a decision on new GM techniques, and things were starting to heat up.

In the spring, the German Government decided to take matters into its own hands. It determined that Cibus' ODM oilseed rape did not qualify as a GMO, so that field trialling could proceed with no regulation or monitoring. In response, the Commission quickly sent letters to Germany and all EU member states asking them to “await, as much as possible, the outcome of the Commission legal interpretation before authorising a deliberate release of organisms obtained with new plant breeding techniques” since “the deliberate release of products which are subject to the rules of the EU GMO legislation without appropriate prior authorisation, is illegal.”64 (See case study 'US company railroads EU decision making on new GM').

But Cibus also informed the Commission that as its product was already being grown in the US, “the harvested material is used like any other crop and likely entering the international commodity chain”. According to the company, the possibility of this unauthorised GM oilseed rape being imported into the EU could therefore not be excluded.65

Following the May 2014 elections, a new Commissioner in charge of DG SANTE (previously called SANCO) was installed, the Lithuanian Vytenis Andriukaitis.66 The NBT Platform set the necessary liaison efforts into motion, and set up a meeting that took place in July 2015. The Platform also shifted focus to liaise and gather information from EU member states, and sought a meeting with the Commission (DGs SANTE, AGRI and Trade) to report back on these contacts.67

Furthermore, at two occasions in 2015, GM developers got assistance from certain member states that have also been peddling a pro-deregulation agenda with Brussels. In May 2015, a ‘non-paper’ authored by Germany, the UK, Ireland and Spain argued for the deregulation of the ODM technique in particular, using the same arguments as put forth by industry to argue that “ODM is a variation of mutagenesis”.68

In September, the German food safety agency BVL, in a joint exercise with its UK and Irish colleagues, sent an interpretation of the definition of a GMO in Directive 2001/18 to the Commission.69 This document precisely echoes the industry discourse that a product should only be regulated under EU GMO laws if it is produced by a GM process and if the result is a product that could not have been achieved in a ‘natural’ way.

Flemish biotechnology institute (VIB) and EASAC join the chorusIn this last phase, corporate-backed research institutes like the Flemish VIB also stepped up their efforts in order to defend their commercial interests. On 5 June 2015, the VIB met with the Commission to discuss a number of new techniques.70 71 Although the list has not been disclosed following freedom of information requests, according to the VIB “... the examples given represent concrete business opportunities and vulnerable information from the viewpoint of competition”. It appears likely from the Commission response and a related email exchange on the topic that the VIB is eyeing cisgenesis and certain gene editing techniques.72 73 VIB has an obvious commercial interest in the deregulation of cisgenesis, after having put its money on turning the failed Dutch cisgenic potato into a Belgian specialty: a blight-resistant Bintje, a well known potato variety widely used for the country's famous fries.74 Moreover, in a remarkable statement addressed to the Commission in July 2015, the European Academies Science Advisory Council (EASAC), also backed industry's views.75 Their political demands dovetail with those of industry: GMOs should be allowed to escape regulation “when they do not contain foreign DNA”, that GM products should be regulated only by trait and not technique, and that the use of the precautionary principle in GM regulation should be reconsidered. The statement is based on the conclusions of an earlier EASAC report, 'Planting the Future'. This report was composed by a working group of experts "acting in individual capacity, nominated by member academies of EASAC". 76 |

Meanwhile, in the European Parliament, some MEPs unsuccessfully demanded a formal say in the process. Others, including Jan Huitema (Liberals) and Anthea McIntyre (Conservatives), authored resolutions that included calls for the deregulation of new GM techniques. On 1 December 2015, a hearing took place in the European Parliament Agriculture Committee. Edwin Hecker, NBT Platform lobbyist and managing partner at Schuttelaar & Partners (although the latter was not disclosed), presented industry's views, again overstating the role of SMEs.77

Surprisingly, only one week later the NBT Platform was deleted from Schuttelaar & Partners' list of clients in the register. However the information in the NBT Platform's entry and on its website remains unchanged. (See box 'Does the NBT Platform still exist?').

Does the NBT Platform still exist?Schuttelaar & Partners made some remarkable changes to their registry entry on 7 December 2015. The NBT Platform has been deleted as a client from the lobby group's entry. This is contradictory, as the NBT Platform’s entry is unchanged and still lists Mr. Hecker as its chair.78 In line with this change, the Commission's legal interpretation of Directive 2001/18 for the new GM techniques has been deleted from the list of EU initiatives followed by the company. In addition, the company's overall lobby-related expenses have been reduced tenfold: from €100,000-500,000 down to €50,000-99,000.79 The consultancy now declares just a 0.8 FTE workload for lobbying activities. This is at odds for instance with the fact that ten employees currently hold lobby passes for the European Parliament.80 |

6. The Commission's interpretation: Whose interests will prevail?

All invested parties are now awaiting the Commission's decision, to be presented in March 2016. Will the NBT Platform be celebrating victory after achieving its 'Phase 4: Agreement' goal? Or will concerned governments, NGOs, and sustainable farming organisations be relieved that the new GM technologies will be subject to the existing hard-won regulation?

Maybe neither. DG SANTE has already publicly stated that “some will be pleased, others disappointed”,81 indicating that at least one, perhaps more, but not all of the new techniques will escape regulation as a result of the Commission decision. If true this would – no matter how many techniques are concerned – be a serious attack on food and environmental safety, consumer choice and transparency in the food chain, as well as enhancing corporate concentration in the seed sector through patents.

As Brussels itself realises, the Commission release is probably just the beginning – and not the resolution – of this contentious issue. In all likelihood, it will be the European Court of Justice that ultimately determines the regulatory fate of new GM techniques. The court case brought by environmental and farming organisations against Cibus' ODM oilseed rape will therefore be of great importance.

In the meantime, neither the biotech industry nor its financiers are likely to have the certainty they have been striving for. Furthermore, other actors may still come into play. Food distributors may demand direct liability for new GM products to those who put them on the market. And parliaments may insist on the labelling of new GM products, like has happened in the Netherlands. The TTIP negotiations, on the other hand, may become a force against a proper regulation of GM 2.0. Environmental and sustainable farming groups will have to remain on high alert.

- 1. - Eckerstorfer M, et al. Environmental Agency Austria. Technical report. New plant breeding techniques and risks associated with their application. 2014. http://www.umweltbundesamt.at/fileadmin/site/publikationen/REP0477.pdf

- Krämer L. Legal questions concerning new methods for changing the genetic conditions in plants. Legal analysis commissioned by Arbeitsgemeinschaft bäuerliche Landwirtschaft (AbL), Bund für Umwelt und Naturschutz (BUND), etc. September 2015. http://www.testbiotech.org/sites/default/files/Kraemer_Legal%20questions...

- Spranger TM. Legal Analysis of the applicability of Directive 2001/18/EC on genome editing technologies. Commissioned by the German Federal Agency for Nature Conservation. October 2015. http://bfn.de/fileadmin/BfN/agrogentechnik/Dokumente/Legal_analysis_of_g... - 2. Steinbrecher, Ricarda. Genetic Engineering in plants and the “New Breeding Techniques (NBTs)”. December 2015. http://www.econexus.info/publication/genetic-engineering-plants-and-new-...

- 3. Corporate Europe Observatory and Inf'OGM. TTIP: released emails show biotech, seeds on the trade talks table. 2 July 2015. http://corporateeurope.org/food-and-agriculture/2015/07/ttip-released-em...

- 4. The Working Group was made up of two experts nominated from each member state. Its final report was completed in 2012, but was never officially published.

- 5. See for a description of the techniques, and reasons why they should be regulated: Steinbrecher, Ricarda. Genetic Engineering in plants and the “New Breeding Techniques (NBTs)”. December 2015. http://www.econexus.info/publication/genetic-engineering-plants-and-new-...

- 6. Testbiotech. Gene-editing and plants & animals used in food production: some technical, socio-economic and legal aspects. Backgrounder for Hearing on “New Techniques for Plant Breeding” in the EP Agriculture Committee. 1 December 2015. http://www.testbiotech.org/sites/default/files/Legal%20and%20technical%2...

- 7. Waltz, Emily. Tiptoeing around Transgenics. In: Nature Biotechnology, volume 30, number 3. March 2012.

- 8. NBT Platform. Fact sheet. New Breeding Techniques: Seizing the opportunity. Version 2013.

- 9. The Commission prioritised these techniques specifically since they entail “the introduction of exogenous [that is, ‘foreign’] genetic material into the host, which is the case for these techniques as it is for transgenesis”.

DG SANCO. Steering note for NBT Platform meeting “The future of plant breeding techniques in the European Union. 25 June 2014. Obtained through Freedom of Information request by CEO. - 10. Several additional pieces of analysis were allocated to the Commission's Joint Research Centre (JRC).

- 11. EFSA. Scientific opinion addressing the safety assessment of plants developed using cisgenesis and intragenesis. 2012. http://www.efsa.europa.eu/fr/efsajournal/pub/2561

- 12. DG SANCO. Background brief at the occasion of visit Mr. Ladislav Miko to Keygene. 26 January 2012. Obtained through Freedom of Information request by CEO.

- 13. DG SANCO. Presentation on New Breeding Techniques at European Seed Association Annual Meeting. 15 October 2012. Obtained through Freedom of Information request by CEO.

- 14. DG SANTE. Email to NBT Platform. 02 July 2015. Obtained through Freedom of Information request by CEO.

- 15. European Parliament. Follow up to the European Parliament resolution on “Plant breeding: what options to increase quality and yields?” (EP reference number: A7-0044/2014 / P7_TA-PROV(2014)0131). 28 May 2014.

- 16. BASF. Letter to DEFRA. 29 April 2013. Obtained through Freedom of Information request by GeneWatch

- 17. Finnish Board of Gene Technology. Letter to Paolo Testori Coggi, Director-General of DG SANCO. 17 February 2014. Obtained through Freedom of Information request by CEO.

- 18. DG SANCO. Letter to Finnish Board for Gene Technology. 25 April 2014. Obtained through Freedom of Information request by CEO.

- 19. NBT Platform two-pager. April 2015. http://www.nbtplatform.org/background-documents/factsheets/2-pager-nbt-p...

- 20. Bussink, Michiel. De strategie in Nederland: 'Geen slapende honden wakker maken'. In: Milieudefensie Magazine. 1999-3.

- 21. RTRS website. Accessed 10 December 2015. http://www.responsiblesoy.org/about-rtrs/governance/task-forces/task-for...

- 22. Corporate Europe Observatory. Roundtable on Responsible Soya - The certifying smokescreen. 22 May 2012. http://corporateeurope.org/sites/default/files/publications/rtrs_briefin...

- 23. DG Trade. Report from meeting with NBT Platform. 07 June 2012. Obtained by Freedom of Information request by CEO.

- 24. European Seed Association. Position paper. New Breeding Techniques – ensuring Progress and Diversity in Plant Breeding. July 2012. https://www.euroseeds.eu/system/files/publications/files/esa_12.0446.2.pdf

- 25. NBT Platform. Fact sheet. New Breeding Techniques: Seizing the opportunity. Version 2013.

- 26. Cnudde F, Dow Agrosciences. Presentation. Use of Zinc Finger Nucleases for plant breeding purposes. May 2012. Obtained through Freedom of Information request by CEO.

- 27. Steinbrecher, Ricarda. Genetic Engineering in plants and the “New Breeding Techniques (NBTs)”. December 2015. http://www.econexus.info/publication/genetic-engineering-plants-and-new-...

- 28. - https://www.grain.org/es/article/entries/588-gm-soybean-latin-america-s-...

- https://lasojamata.net/files/paraguay-humanrights-report.pdf - 29. Testbiotech. Gene-editing and plants & animals used in food production: some technical, socio-economic and legal aspects. Backgrounder for Hearing on “New Techniques for Plant Breeding” in the EP Agriculture Committee. 1 December 2015. http://www.testbiotech.org/sites/default/files/Legal%20and%20technical%2...

- 30. Fagan J, Antoniou M, Robinson C. Earth Open Source. GMO Myths and Truths. 2014. http://gmomythsandtruths.earthopensource.org/

Greenpeace. Twenty years of failure. Why GM crops have failed to deliver on their promises. November 2015. http://www.greenpeace.org/international/Global/international/publication... - 31. NBT Platform two-pager. April 2015. http://www.nbtplatform.org/background-documents/factsheets/2-pager-nbt-p...

- 32. NBT Platform. Email to DG Trade. 18 May 2015. Obtained through Freedom of Information request by CEO. Doc 2 A2D Trade

- 33. NBT Platform two-pager. April 2015. http://www.nbtplatform.org/background-documents/factsheets/2-pager-nbt-p...

- 34. EU Transparency Register. Accessed 11 January 2016. http://ec.europa.eu/transparencyregister/public/consultation/displaylobb...

- 35. The lobbying activities covered by the register include all those that are “carried out with the objective of directly or indirectly influencing the formulation or implementation of policy and the decision-making processes of the EU institutions, irrespective of where they are undertaken and of the channel or medium of communication used, for example via outsourcing, media, contracts with professional intermediaries, think tanks, platforms, forums, campaigns and grassroots initiatives.” Article 7. http://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:32014Q0919...

- 36. Website NBT Platform. Accessed 8 November 2015. Compared to a list provided in 2014, two members dropped off: Cellectis Plant Sciences and Centre R&D Nestlé Tours. http://www.nbtplatform.org/

- 37. DG SANCO. Steering note for Mr Ladislav Miko at the occasion of a visit by Mr Hugo von Meijenfeldt. Acting DG Environment, Environment Ministry Netherlands. 15 November 2012.

- 38. DG Trade. Report from meeting with NBT Platform. 07 June 2012. Obtained by Freedom of Information request by CEO.

- 39. Inova Fruit is owned by five shareholders, all large fruit auction companies. 49% of shares are owned for instance by the Greenery that has over 1400 employees.

- 40. For example: Rothamsted Research website. As accessed 11 January 2016. http://www.rothamsted.ac.uk/news/new-collaborative-research-project-gets...

- 41. VIB website. As accessed 21 December 2015. http://www.vib.be/nl/over-vib/organisatie/Paginas/Algemene-vergadering.aspx

- 42. ENERGYPOPLAR website. As accessed 21 December 2015. http://www.energypoplar.eu/institutions.php?id=40

- 43. NBT Platform two-pager. April 2015. http://www.nbtplatform.org/background-documents/factsheets/2-pager-nbt-p...

- 44. DG SANCO. Notes of meeting with NBT Platform of 31 May 2012. 06 June 2012. Obtained through Freedom of Information request by CEO.

- 45. NBT Platform. Proposed agenda for meeting on 22 June 2012. Obtained through Freedom of Information request by CEO.

- 46. Schouten, Henk. Wageningen University and Research Center and Inova Fruit. Presentation to European Commission. Legal arguments to keep plants from novel breeding techniques such as cisgenesis outside the GMO regulation. 22 June 2012. Obtained through Freedom of Information request by CEO.

- 47. Kempen, F.; C. Jung. Genetic Modification of Plants: Agriculture, Horticulture and Forestry. 2010. In: Biotechnology in Agriculture and Forestry. Springer. http://elibrary.com.ng/UploadFiles/file0_10097.pdf

- 48. Schuttelaar & Partners was also hired for this project to draw up a communication plan “for the acceptance and marketing” of the cisgenic apple. National Academic Research and Collaborations Information System website. As accessed 12 January 2016. http://www.narcis.nl/research/RecordID/OND1310571

- 49. NBT Platform. Email to DG SANCO. 10 July 2012. Obtained through Freedom of Information request by CEO.

- 50. DG Trade. Report from meeting with NBT Platform. 07 June 2012. Obtained through Freedom of Information request by CEO.

- 51. DG Trade. Report from meeting with Schuttelaar & Partners on new breeding techniques. 15 March 2012. Obtained through Freedom of Information request by CEO.

- 52. European Seed Association (ESA). Position paper. Promoting and Enabling Innovation in Plant Breeding. February 2014. Obtained through Freedom of Information request by CEO.

- 53. NBT Platform. Legal Briefing Paper. The regulatory status of plants resulting from New Breeding Technologies. Version of 28 May 2013. Obtained through Freedom of Information request by CEO.

- 54. NBT Platform. Summary of Legal Briefing Paper “The regulatory status of plants resulting fromNew Breeding Technologies”. Obtained through Freedom of Information request by CEO. 22 May 2013. doc 51.2

- 55. The Directive 2001/18 (Annex 1B) lists two techniques – cell fusion and mutagenesis – for which an exemption has been granted, and that are therefore excluded from its scope. As these two techniques predated the Directive by many years, EU authorities assumed there was a ‘history of safe use’.

- 56. The following documents exemplify the pro-deregulation arguments. Each uses one or more of the points listed in the table.

- European Technology Platform Plants for the Future. Position paper. New Breeding Techniques - Ensuring an Innovative and Diversified European Agriculture. September 2012. http://www.epsoweb.org/file/1096

- European Seed Association. Regulatory approaches to modern plant breeding - the case of mutagenesis and new gene editing technologies. 20 July 2015. https://www.euroseeds.eu/system/files/publications/files/esa_15.0543_0.pdf

- CropLife International. Position Paper. Regulatory oversight of products developed through new breeding techniques. 2014. https://croplife.org/wp-content/uploads/pdf_files/Regulatory-Oversight-o...

- NBT Platform. Factsheet. Oligonucleotide-Directed Mutagenesis: accelerating innovation. 2013. http://www.nbtplatform.org/background-documents/factsheets/factsheet-oli...

- NBT Platform. Legal Briefing Paper. The regulatory status of plants resulting from New Breeding Technologies. Version of 28 May 2013. - 57. - Krämer L. Legal questions concerning new methods for changing the genetic conditions in plants. Legal analysis commissioned by Arbeitsgemeinschaft bäuerliche Landwirtschaft (AbL), Bund für Umwelt und Naturschutz (BUND), etc. September 2015. http://www.testbiotech.org/sites/default/files/Kraemer_Legal%20questions...

- Spranger TM. Legal Analysis of the applicability of Directive 2001/18/EC on genome editing technologies. Commissioned by the German Federal Agency for Nature Conservation. October 2015. http://bfn.de/fileadmin/BfN/agrogentechnik/Dokumente/Legal_analysis_of_g...

- Cotter J, Zimmermann D, Van Bekkem H. Greenpeace. Applications of the EU and Cartagena definitions of a GMO to the classification of plants developed by cisgenesis and gene-editing techniques. 2015. http://www.greenpeace.to/greenpeace/wp-content/uploads/2015/11/Applicati...

- Reseau Semences Paysannes, Confederation Paysanne et al. Statut juridique des produits issus des "nouvelles techniques de modification génétique des plantes" - 58. DG SANCO. Notes from meeting with NBT Platform. 21 March 2014. Obtained through Freedom of Information request by CEO.

- 59. NBT Platform and ETP Plants for the Future. Meeting report. Multilateral meeting ‘the future of plant breeding techniques in the European Union’. Obtained through Freedom of Information request by CEO. 25 June 2014.

- 60. Ibid.

- 61. Dow Agrosciences and DG SANCO/JRC. Emails April 2012 and July 2013. Obtained through Freedom of Information request by CEO.

- 62. DG SANCO. Internal email. 8 July 2013. Obtained through Freedom of Information request by CEO.

- 63. Corporate Europe Observatory and Inf'OGM. TTIP: released emails show biotech, seeds on the trade talks table. 2 July 2015. http://corporateeurope.org/food-and-agriculture/2015/07/ttip-released-em...

- 64. European Commission. Letter to Competent Authorities. 5 June 2015. Obtained through Freedom of Information request by CEO.

- 65. Cibus Europe. Letter to DG SANCO. January 2015. Obtained through Freedom of Information request by CEO.

- 66. Schuttelaar & Partners. Letter to Commissioner Vytenis Andriukaitis. 1 December 2014. Obtained through Freedom of Information request by CEO.

- 67. NBT Platform. Email to Mr Ladislav Miko (DG SANTE). 26 February 2015. Obtained through Freedom of Information request by CEO.

NBT Platform. Email to DG Trade. 18 May 2015. Obtained through Freedom of Information request by CEO. - 68. According to Agrafacts, the non-paper was authored by German, UK, Irish and Spanish authorities.

Non-paper on the regulatory status of plants generated by oligonucleotide-directed mutagenesis (ODM). 21 May 2015. Obtained through Freedom of Information request by CEO. - 69. BVL. Legal interpretation to DG SANTE. 28 September 2015. Obtained through Freedom of Information request by CEO.

- 70. DG SANTE. Reply to Vlaams Instituut voor Biotechnologie (VIB). 9 July 2015. Obtained through Freedom of Information request by CEO. (doc 24 a2d3).

- 71. Vlaams Instituut voor Biotechnologie (VIB). Letter to Mr Ladislav Miko (DG SANTE). 10 June 2015. Obtained through Freedom of Information request by CEO.

- 72. DG SANTE. Reply to Vlaams Instituut voor Biotechnologie (VIB). 9 July 2015. Obtained through Freedom of Information request by CEO.

- 73. Vlaams Instituut voor Biotechnologie (VIB). Email to DG SANTE. 6 July 2015. Obtained through Freedom of Information request by CEO.

- 74. VIB. Fact series. Een schimmelresistente aardappel voor België. December 2014. http://www.vib.be/nl/educatie/Documents/VIB_dossier_%20schimmelresistent...

- 75. EASAC. Statement on New Breeding Techniques. July 2015. http://www.easac.eu/fileadmin/PDF_s/reports_statements/Easac_14_NBT.pdf

- 76. EASAC. Planting the Future - opportunities and challenges for using crop genetic improvement technologies for sustainable agriculture. June 2013. http://www.easac.eu/fileadmin/Reports/Planting_the_Future/EASAC_Planting...

However, one third of the working group are also member of PRRI, an industry-minded lobby group of 'public scientists'.

Corporate Europe Observatory. PRRI - Are these public researchers? 2008. http://corporateeurope.org/food-and-agriculture/2008/06/prri-are-these-p... - 77. European Parliament Committee on Agriculture. Hearing on “New Techniques for Plant Breeding”. 1 December 2015. https://polcms.secure.europarl.europa.eu/cmsdata/upload/d35d2641-ab77-49...

- 78. Furthermore, Schuttelaar & Partners now lists only one client (Grodan, a supplier to the horticulture sector). This is in sharp contrast to the lobby firm’s own website, where 11 clients from the food and biotech sectors are listed as examples of “current and recent clients”.

Schuttelaar & Partners website. As accessed 13 December 2015. http://www.schuttelaar-partners.com/clients - 79. EU Transparency Register website. As accessed 15 November 2015. (No longer in public domain, available from CEO).

- 80. EU Transparency Register. Accessed 16 January 2016.

- 81. Dorothée Andrée, DG SANTE. Comment at EP Agriculture Committee hearing. 1 December 2015.

Comments

Its sad that europeans dont belive that regulations should be supported by science

And regulate anything that sounds scary in a knee jerk fashion even when the scientific consensus says its not only safe but has no mechanism to be harmfull