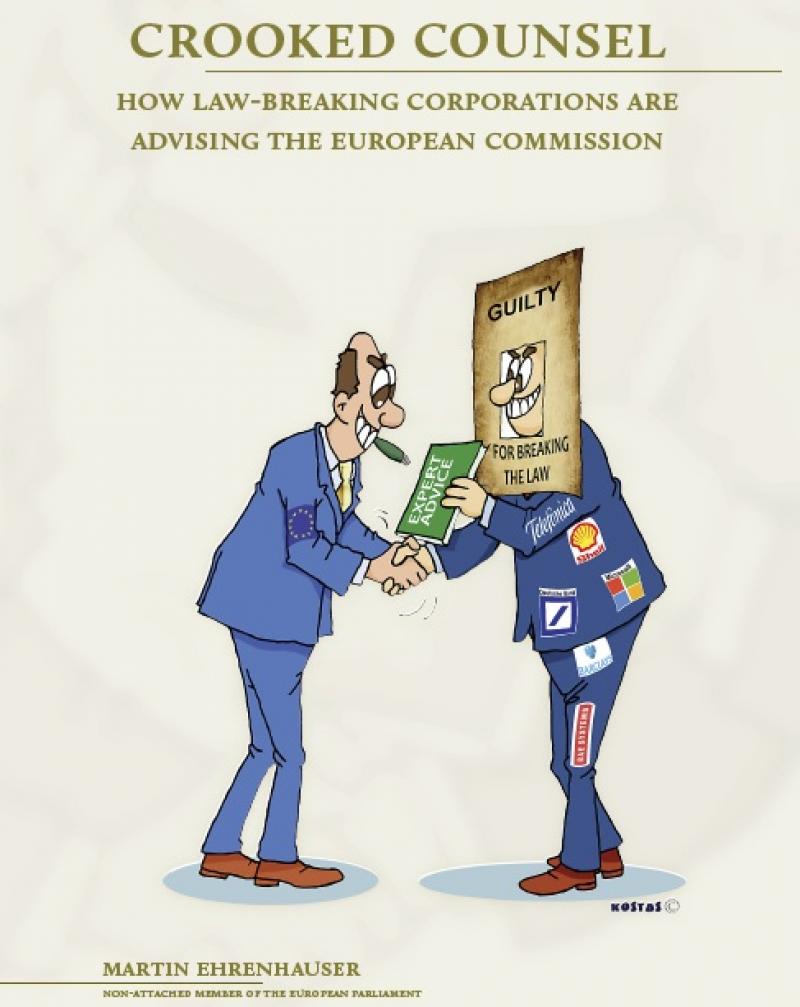

Crooked Counsel: How law-breaking corporations are advising the European Commission

New report by MEP Martin Ehrenhauser

There would be a public outcry if advisors to our national politicians or civil servants were recently convicted for illegal activity on the very topic they were advising on. Yet a new report by MEP Martin Ehrenhauser* shows how corporations that have been found guilty of or are under investigation for serious ethical, financial or environmental misconduct are actively advising the Commission.

The ten corporations covered in the report dominate their industries, with numerous household names among them such as Shell, Deutsche Bank, Microsoft and Telefonica. In many cases, the guilty corporations actually stand to gain financially either directly or indirectly from the advisory roles they play.

Asking a bank like Barclays for advice on regulating financial markets when its been found to have been illegally manipulating them can only serve to bring the Commission's credibility even further into disrepute. Why are corporations that are not following current laws and regulations being asked to draft new ones?

The report outlines some clear and implementable solutions such as a new blacklisting system (which could be combined with Commission's current inadequate one), as well as implementing the four conditions called for by the European Parliament (no corporate dominated groups; no lobbyists sitting in a personal capacity; open calls for all groups; full transparency).

Another Expert Mess

There are many parts to the European Commission's advisory system, but a key focus of the report is on the highly-problematic Expert Groups and the European Supervisory Authority's three key branches (European Banking Authority – EBA; European Securities and Markers Authority – ESMA; the European Insurance and Occupational Pensions Authority – EIOPA). As CEO and ALTER-EU have already shown, politically and economically important Expert Groups continue to be dominated by representatives of corporate interests, while many groups' independent experts also represent corporate interests – and the same situation occurs within the ESAs. This is despite the European Commission promising to clean up its expert group system after the Parliament froze the budget in 2011. This report is yet another example of how public policy making is falling into the wrong hands, and how corporations – including those found guilty of breaking the law – are being given a privileged role in forming European laws and regulations.

The report looks at ten corporations from the defence, digital, finance and extractive industries to highlight the problem, but in no ways is the list exhaustive – there are many more examples of law-breaking corporations taking part in the Commission's advisory system.

The Ten Crooked Counsellors

Defence

1. BAE Systems – Britain's largest defence company; paid £300m in 2010 in criminal fines; prominent member of the defence Expert Group system over the past few years:

Should a company involved in numerous corruption charges involving arms dealing, as well as using elaborate offshore tax havens, be advising the Commission on both defence issues and tackling tax evasion?

2. Finmeccanica – Italy's biggest high-tech company; past and current chief executives separately facing trial or under investigation for presiding over a system of bribery and corruption that was “part of the company philosophy”; influential member of at least eight Expert Groups over the past decade:

Why is a company accused of corruption on arms deals advising the Commission on how the EU spends its defence research budget?

3. EADS/Airbus – French/German defence giant; being investigated separately by France, the UK and Germany for serious criminal charges; key in influencing the EU's security agenda and still involved in the Key Emerging Technologies High Level Commission Expert Group:

Should the Commission be taking advice on defence from a company embroiled in numerous investigations for allegations of bribery and insider trading regarding arms deals; or on key technologies that it stands to benefit from?

Digital

4. Microsoft – one of the world's largest technology companies; has fought a series of anti-trust cases since late 1990s brought by the Commission; advises the Commission on higher education modernisation while promoting its own high-tech solutions:

Should the Commission be taking advice on the direction of education policy against a serial-offender against rules to prevent monopolies; and who could stand to benefit from the technology decisions taken in the education field?

5. Téléfonica – largest telecoms operator in Spain (and owns O2); fined €152m in 2007 and €67m in 2013 for anti-competitive behaviour; sits in Expert Groups and ESAs:

How does it enhance the integrity of EU policy if a company repeatedly involved in market-fixing is also advising it on financial markets as well as the expansion of new markets?

Finance

6. Barclays – one of Europe's biggest banks; one of the worst offenders for mis-selling and manipulating various key financial interest rates and policies; sat on key financial regulation Expert Groups and still sits within ESMA:

How is a bank that has been found guilty of manipulating various financial and commodity markets now advising the Commission on commodity markets or on the regulation of the European financial system?

7. Deutsche Bank – Eurozone's largest bank by assets; found guilty of manipulating European and Japanese interest rates as part of a cartel, and mis-selling mortgage-backed securities in the US; sat on key derivatives expert group and sits on more than five ESMA and EBA advisory committees:

Should the Commission look for financial advice from a bank that is still being investigated for numerous illegal financial activities from both before and after the financial crisis?

8. Santander – Eurozone's largest bank by market value; senior wealth manager of their Geneva-based hedge-fund faces criminal prosecution for losing clients €2.3 billion via Bernie Madoff's 'ponzi scheme' and Portugal is suing them for mis-selling 'toxic' derivatives; was and is involved in important Expert Groups and ESA bodies:

Why was a bank facing legal action from national governments over its derivatives trading allowed to advise the Commission on derivatives?

9. KPMG – one of the global 'Big 4' accountancy firms; facing numerous investigations from UK authorities over suspicious audits, including failed bank HBOS and BAE Systems; sits in Expert Group on corporate tax avoidance and numerous ESMA groups, monitoring accounting and auditing regulations:

Should a corporate accountancy firm whose practices have hidden huge losses and encouraged the use of tax havens, as well as being fined for serious conflicts of interest, be advising the Commission on tax evasion?

Extractives

10. Shell – the world's biggest oil company by revenue; found guilty in 2013 of polluting Nigerian farmland and currently facing a compensation case in the UK brought by 15,000 Bodo community members; was involved in technology expert groups pushing false solutions to climate change:

Why has an oil company continuously fined and taken to court for environmental and human rights abuses, corruption charges and tax avoidance been asked to advise on lowering emissions and tax avoidance?

Fixing a Broken Advisory System

The report highlights how broken the advisory system is, and the urgency of fixing it if the challenge to the integrity, transparency and credibility of the European Commission's policy making process is to be overcome. This means removing offending corporations from the advisory system:

Companies found guilty of illegal activity should be banned for at least five years, with all names of companies made publicly available;

Companies actively under investigation should be suspended until the end of the investigation, given the gravity of launching an official investigation;

Companies found guilty should be placed on the Commission's much-criticised existing 'Central Exclusion Database', which should be improved and made public (this would mean they would not be able to access EU funds).

2014 will see a not just a new European Parliament but also a new European Commission. These steps – alongside the four conditions outlined by the Parliament in 2011 – should be prioritised by the new Commission, but to do so incoming MEPs must also demand commitments to action from potential Commissioners during the hearings. But ALTER-EU hopes the new Parliament will contain have many transparency champions ready to tackle corporate lobbying.

So far, more than 750 MEP candidates have signed ALTER-EU's www.politicsforpeople.eu pledge which asks them – among other things – to take action on ending corporate dominance within advisory groups once elected, as well as hold incoming Commissioners to account. This is vital, as in 2015 the rules governing Expert Groups are expected to be reviewed, providing a great opportunity to ensure the problem is fixed for the long-term.

However, experience has shown that the Commission is unlikely to act without serious pressure. Previously, action only came after freezing the Expert Group budgets, which – given the lack of progress since the budget was lifted – should be a priority action for 2015 (although the decision is taken in autumn 2014). This can ensure that conditions are met and the rule changes are adequate.

This report underlines once more that a serious overhaul of the Commission's advisory system is needed to ensure it acts in the public interest rather than that of corporations – many of whom are unable to follow current laws yet get to advise on new ones. It should act as a wake-up call for the Commission and a call-to-action for incoming MEPs who are serious about tackling lobbying from banks and big business.

*CEO provided advice and guidance in the researching of the report